Disclaimer:

Please be aware that the content herein is comprised of personal reflections, observations, and insights from our contributors. It is not necessarily exhaustive or authoritative, but rather reflects individual perspectives. While we aim for accuracy, we cannot guarantee the completeness or up-to-date nature of the content.

Innovation Solution Description

Interoperable financial service distribution Solutions

Qualitative Results of the Innovation

1. Increased financial inclusion: According to a survey by the Central Bank of Kenya, financial inclusion in Kenya increased from 26.7% in 2006 to 82.9% in 2019. MFS Africa's digital platform has contributed to this increase by providing affordable and accessible financial services to people in remote border areas of the country.

2. Increased access to finance: MFS Africa's platform has made it easier for people in border areas of Kenya to access financial services, such as savings, credit, and insurance. The company has partnered with several financial institutions in Kenya to provide these services to its users.

3. Increased remittances: MFS Africa's platform has made it easier and cheaper for people in border areas of Kenya to send and receive money across borders. The company's platform connects mobile money operators, banks, and other financial institutions, making it easier for people to send and receive money from other countries.

4. Reduced transaction costs: MFS Africa's platform has significantly reduced the cost of sending and receiving money across borders. According to a report by the World Bank, the average cost of sending money to Kenya was 7.8% in the first quarter of 2021, compared to the global average of 6.5%. However, MFS Africa's platform has reduced the cost of remittances to Kenya to as low as 3%.

5. Increased economic growth: MFS Africa's platform has contributed to the economic growth of border areas of Kenya by increasing access to finance and reducing transaction costs. This has led to increased economic activity and improved livelihoods for people in these areas.

Quantitative Result of the Innovation

1. Increased financial inclusion: According to MFS Africa, their platform has enabled over 320 million mobile money users across Africa to access digital financial services. This has led to increased financial inclusion, with more people having access to formal financial services.

2. Improved cross-border payments: MFS Africa's platform has also improved cross-border payments in Africa. In 2019, the company processed over 26 million cross-border transactions worth over $1.2 billion, representing a 70% increase from the previous year.

3. Increased merchant payments: MFS Africa has also facilitated increased merchant payments across Africa. In 2019, the company processed over 22 million merchant payments worth over $800 million.

4. Enhanced partnerships: MFS Africa has partnered with over 200 financial service providers, including mobile network operators, banks, and payment platforms, to improve financial inclusion and promote innovation in Africa's financial sector.

5. Funding and valuation: As of September 2021, MFS Africa has raised over $200 million in funding and is valued at over $1 billion, making it one of the most successful fintech companies in Africa.

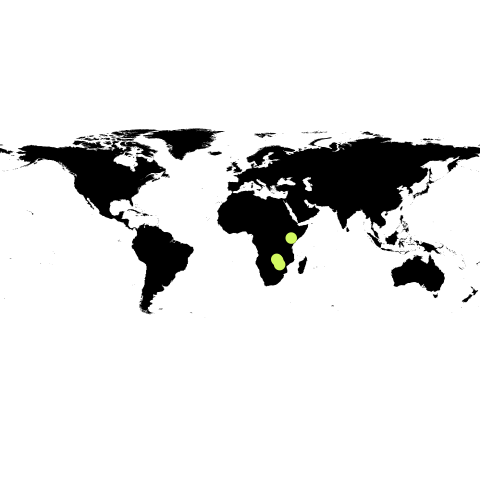

Border Area

1. Moyale - located on the border between Kenya and Ethiopia

2. Malaba - located on the border between Kenya and Uganda

3. Busia - located on the border between Kenya and Uganda

4. Kasumbalesa - located on the border between Zambia and the Democratic Republic of Congo (DRC)

5. Chirundu - located on the border between Zambia and Zimbabwe

6. Lebombo - located on the border between South Africa and Mozambiqu

7. Beitbridge - located on the border between South Africa and Zimbabwe

Region

Pan Africa

Organization

M*************************************************************************************o@mfsafrica.com

Tel:

Consent/Link

Consent to share form or official link.

Consent to share form or official link.

1No poverty

1No poverty 8Decent work and economic growth

8Decent work and economic growth 9Industry, innovation and infrastructure

9Industry, innovation and infrastructure 10Reduced inequalities

10Reduced inequalities

Comments

Log in to add a comment or reply.