Disclaimer:

Please be aware that the content herein is comprised of personal reflections, observations, and insights from our contributors. It is not necessarily exhaustive or authoritative, but rather reflects individual perspectives. While we aim for accuracy, we cannot guarantee the completeness or up-to-date nature of the content.

Innovation Solution Description

Alternative payment methods for global, regional and local merchants.

Qualitative Results of the Innovation

1. Increased Financial Inclusion: Cellulant provides access to financial services to previously unbanked individuals.

2. Improved Access to Finance: In Kenya, Cellulant partnered with the government to provide a mobile-based platform for farmers to access credit and other financial services. This platform has helped increase the number of farmers accessing finance and has also reduced the cost of borrowing.

3. Increased Efficiency in Border areas: According to a report by the International Finance Corporation, Cellulant's platform has helped reduce the cost and time it takes to send and receive cross-border payments. This has helped improve trade in border areas and has also increased access to remittances for families living in these areas.

4. Scale and Reach: Cellulant's platform is available in over 20 countries in Africa, and the company has over 30 million users. The company has also partnered with over 90 banks and financial institutions to provide its services. This scale and reach have helped increase access to finance and financial inclusion in border areas across the continent.

5. Improved Cross-Border Payments: Cellulant's digital payments platform has also made it easier for businesses to conduct cross-border transactions. This has increased trade and commerce in border areas of Africa, which has led to economic growth and development.

Quantitative Result of the Innovation

1. Improved efficiency: Cellulant's digital payments platform has also helped to improve efficiency in financial transactions in Africa. According to the same IFC report, the Agrikore platform has reduced transaction costs for farmers by up to 80%, enabling them to access finance at more affordable rates.

2. Increased revenue: According to a report by McKinsey, the adoption of digital payments could increase Africa's GDP by $300 billion by 2025. Cellulant's platform has enabled businesses to access a wider customer base and increase their revenue streams.

3. Job creation: Cellulant has also created job opportunities for developers, customer service agents, and other professionals.Fintech Unlocked, the fintech sector in Africa could create up to 3 million new jobs by 2025.

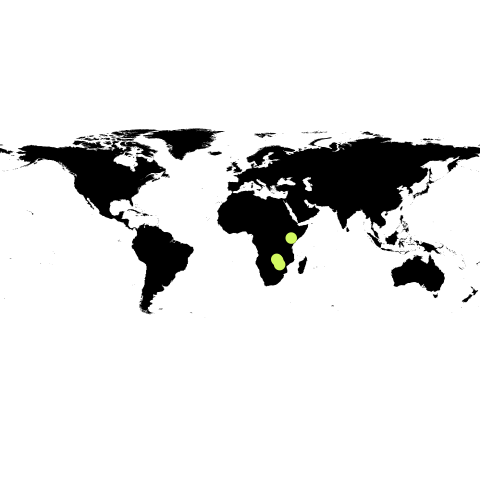

Border Area

1. Moyale - located on the border between Kenya and Ethiopia

2. Busia - located on the border between Kenya and UgandaMalaba - located on the border between Kenya and Uganda

3. Kasumbalesa - located on the border between Zambia and the Democratic Republic of Congo (DRC)

4. Chirundu - located on the border between Zambia and Zimbabwe

Region

Pan Africa

Organization

C***************************************************************************o@cellulant.io

Tel: +254 20 2606696

Consent/Link

Consent to share form or official link.

Consent to share form or official link.

1No poverty

1No poverty 8Decent work and economic growth

8Decent work and economic growth 9Industry, innovation and infrastructure

9Industry, innovation and infrastructure 10Reduced inequalities

10Reduced inequalities

Comments

Log in to add a comment or reply.