Disclaimer:

Please be aware that the content herein is comprised of personal reflections, observations, and insights from our contributors. It is not necessarily exhaustive or authoritative, but rather reflects individual perspectives. While we aim for accuracy, we cannot guarantee the completeness or up-to-date nature of the content.

Innovation Solution Description

Financial inclusion and credit Scoring

Qualitative Results of the Innovation Solution

1. Increased agricultural productivity: [REDACTED]'s loans have enabled smallholder farmers to access modern farming inputs, such as improved seeds, fertilizers, and pesticides. As a result, farmers have been able to increase their crop yields and enhance their income. According to a study by the International Food Policy Research Institute, farmers who received loans from [REDACTED] increased their crop yields by up to 46%. 2. Adoption of new farming technologies: [REDACTED] has introduced farmers to innovative farming technologies, such as drip irrigation and greenhouse farming. These technologies have enabled farmers to grow crops throughout the year, leading to increased income and food security. According to [REDACTED]'s impact report, over 11,000 farmers have adopted drip irrigation technology, leading to a 40% increase in crop yields. 3. Improved access to markets: [REDACTED] has facilitated access to markets for smallholder farmers by providing training on market-oriented agriculture and linking farmers to buyers. This has enabled farmers to get better prices for their produce, leading to increased income. According to [REDACTED]'s impact report, farmers who received loans from the organization increased their income by an average of 37%. 4. Increased financial inclusion: [REDACTED]'s microfinance model has enabled smallholder farmers to access credit, which was previously unavailable to them. This has improved financial inclusion among rural communities and enabled them to invest in their farming enterprises. According to [REDACTED]'s impact report, the organization has disbursed over Ksh. 14 billion in loans, enabling over 400,000 farmers to access credit.

Quantitative Result of the Innovation

1. Increased Access to Finance: Microfinance institutions like [REDACTED] have increased access to finance for small-scale farmers and agribusinesses. According to a report by the World Bank, microfinance has helped over 16 million clients in East Africa access financial services, with over $8 billion in loans disbursed. 2. Improved Agricultural Productivity: Improved access to finance has led to increased investment in agricultural productivity. According to the same World Bank report, microfinance has helped over 600,000 small-scale farmers in East Africa increase their productivity and income. 3. Expansion of Agribusinesses: Access to finance has also enabled small-scale farmers to expand their businesses and invest in new technologies and inputs. According to a study by the International Finance Corporation (IFC), microfinance has helped to create over 1.1 million new jobs in East Africa's agriculture sector. 4. Improved Food Security: The increased productivity and expansion of agribusinesses have also contributed to improved food security in the region. According to the United Nations, the number of undernourished people in East Africa decreased from 33 million in 2015 to 28 million in 2019. 5. Environmental Sustainability: Microfinance has also played a role in promoting environmentally sustainable agricultural practices. According to the IFC, microfinance institutions have provided financing for investments in renewable energy and energy efficiency in the agriculture sector in East Africa.

Border Area

Busia County Migori County Homa Bay County

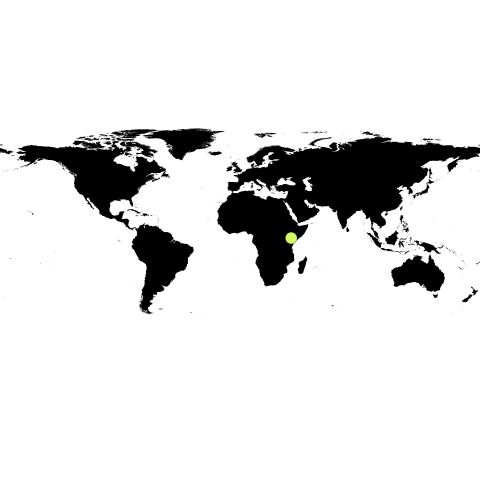

Region

East Africa

Organization

[REDACTED] Address: Nairobi, Kenya E-mail: [REDACTED] Tel: +[REDACTED] 20 00

Consent/Link

Consent to share form or official link.

Consent to share form or official link.

1No poverty

1No poverty 2Zero hunger

2Zero hunger 10Reduced inequalities

10Reduced inequalities

Comments

Log in to add a comment or reply.