Disclaimer:

Please be aware that the content herein is comprised of personal reflections, observations, and insights from our contributors. It is not necessarily exhaustive or authoritative, but rather reflects individual perspectives. While we aim for accuracy, we cannot guarantee the completeness or up-to-date nature of the content.

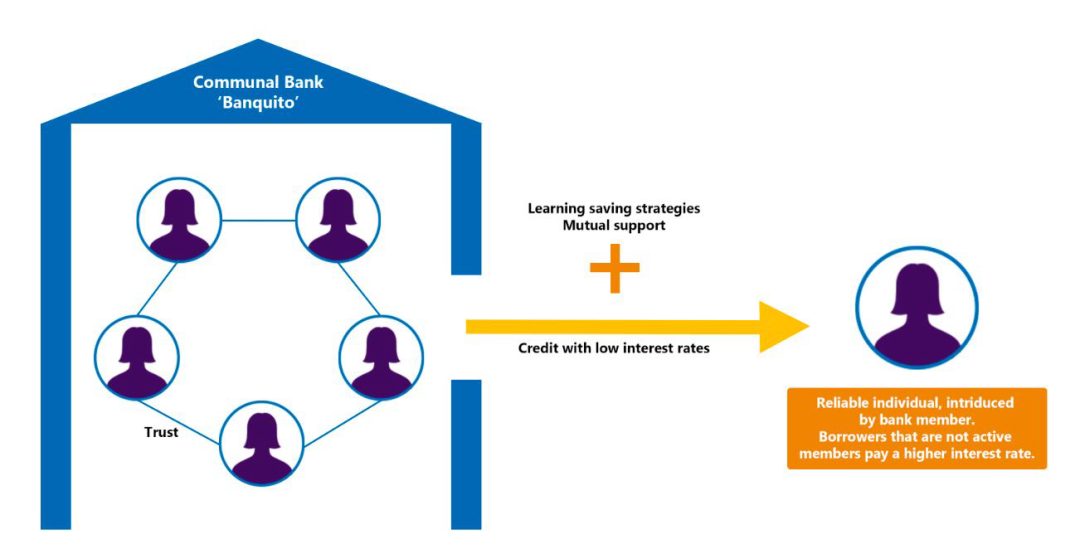

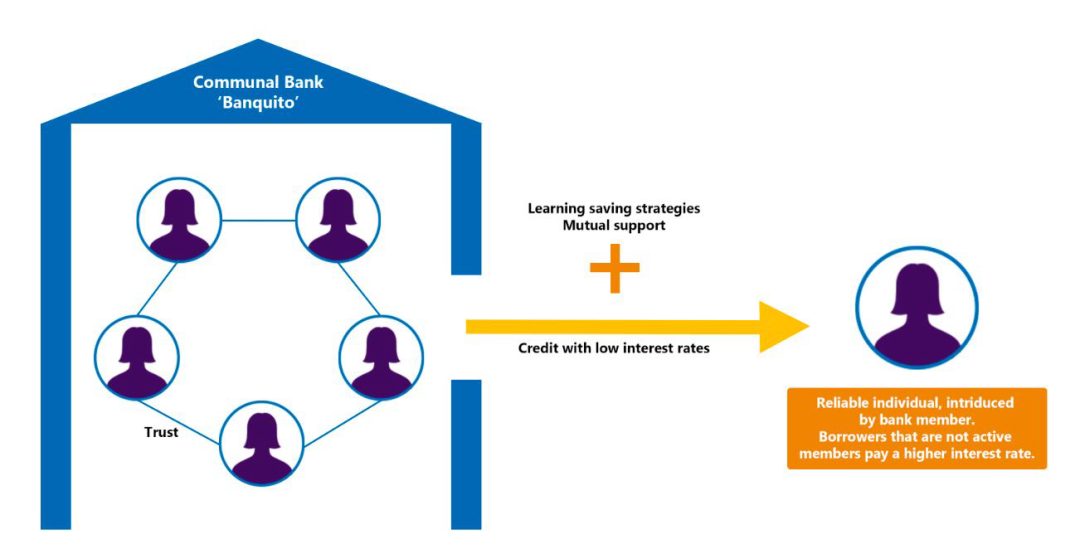

It can be very challenging for low-income households to access to financing through traditional sources. This can be related to a low level of financial soundness, and their mostly precarious and/or temporary access to the labor market means that they are mostly in the informal sector of the economy. In this situation, people turn to communal banks as a source of extraordinary capital, which they could not have been able to attain on their own. Communal banking is a method based on microcredits. According to this method, a civil society organization brings together a group of people—usually women from low-income neighborhoods, who know each other and get together by bonds of trust—to manage the delivery of credit, saving strategies, and mutual support. Following this logic, communal banks are spaces anchored in people’s social capital, where credit is granted to reliable individuals, introduced by bank members who also act as guarantors. Borrowers who are not active members of the space pay a higher interest rate. In order to build a group of partners, the organizations that lend the money usually look for referents in the field. The group members establish a meeting point, draw up a set of rules of coexistence, and meet regularly. These women typically adopt different rotating roles. Apart from this, we observed throughout our fieldwork that the communal banks (called banquitos—little banks—in the territory) usually have a will to expand. Communal banks are also a space for the acquisition/socialization of financial planning learning that is then transferred to the household economy. Although this is not the initial purpose of a communal bank, its members—by managing it—go through a learning process that allows them to recognize their spending structure and try to optimize it. The process of supporting business ventures development in practice allows them to observe how others solve problems or apply their knowledge. The lessons are not purely on a theoretical level (accounting, financial, etc.). These experiences can help people recognize, for example, the importance of each expense (including, for instance, the pinch of salt used to prepare a meal to be sold) when setting the prices of the products or services to be sold. During the field work conducted for our mapping “Close up: Financial Inclusion and Grassroots Solutions”, we observed a communal bank operation and, afterwards, asked some of its members what the most important lesson learned had been. Instead of focusing on their income, people talked about their expenses and told us that the real change had begun by identifying how they had been spending their money: “Thanks to the banquito, I learned how to manage at home. For example, I take a blank piece of paper and write down my expenses; thus, at the end of the month, I know how much money I paid for cable, telephone, and gas services”.– Woman, member of the communal bank in José León Suárez “With this (the communal bank), I learned to reduce expenses. Telephones... I ask myself: Why do I buy three if I need one?” – Woman, member of the communal bank in José León Suárez The interviewees agreed that this experience helped them stop buying items they did not use (for example, some products that got spoiled because they were not consumed), avoid the temptation of discounts, stop asking for loans to pay debts, among other adjustments. After identifying how money was spent in their homes and making small changes in their household economies, the members of the communal bank claimed that they could put aside some money to save, plan and achieve goals that, before, they thought were out of their reach. These testimonies reflected a process that made them proud, and through which they were improving their control over their finances. They also showed how behavioral change occurred as a group, as learning was shared among their colleagues. While financial education is not an end in itself, it is a means for individuals to better manage household finances, develop a business venture, or achieve an otherwise distant goal. To do this, closeness and trust are fundamental elements, and in that establishing a shared space where inhibition barriers—not knowing something, having doubts, or making mistakes—are reduced. Finally, learning by doing is associated with behavioral changes (good habits, use of better tools, etc.), and can be very rewarding for people.

https://www.undp.org/es/argentina/publications/mujeres-en-red-soluciones-financieras-y-de-recuperacion-socioeconomica

https://www.undp.org/es/argentina/publications/busqueda-compartida-mapeo-de-soluciones-colaborativo-inclusion-financiera-y-recuperacion-economica

https://www.undp.org/es/argentina/publications/de-cerca-inclusion-financiera-y-soluciones-territoriales

Consent to share form or official link.

Consent to share form or official link.

1No poverty

1No poverty 5Gender equality

5Gender equality 8Decent work and economic growth

8Decent work and economic growth 10Reduced inequalities

10Reduced inequalities 17Partnerships for the goals

17Partnerships for the goals

Comments

Log in to add a comment or reply.