Disclaimer:

Please be aware that the content herein is comprised of personal reflections, observations, and insights from our contributors. It is not necessarily exhaustive or authoritative, but rather reflects individual perspectives. While we aim for accuracy, we cannot guarantee the completeness or up-to-date nature of the content.

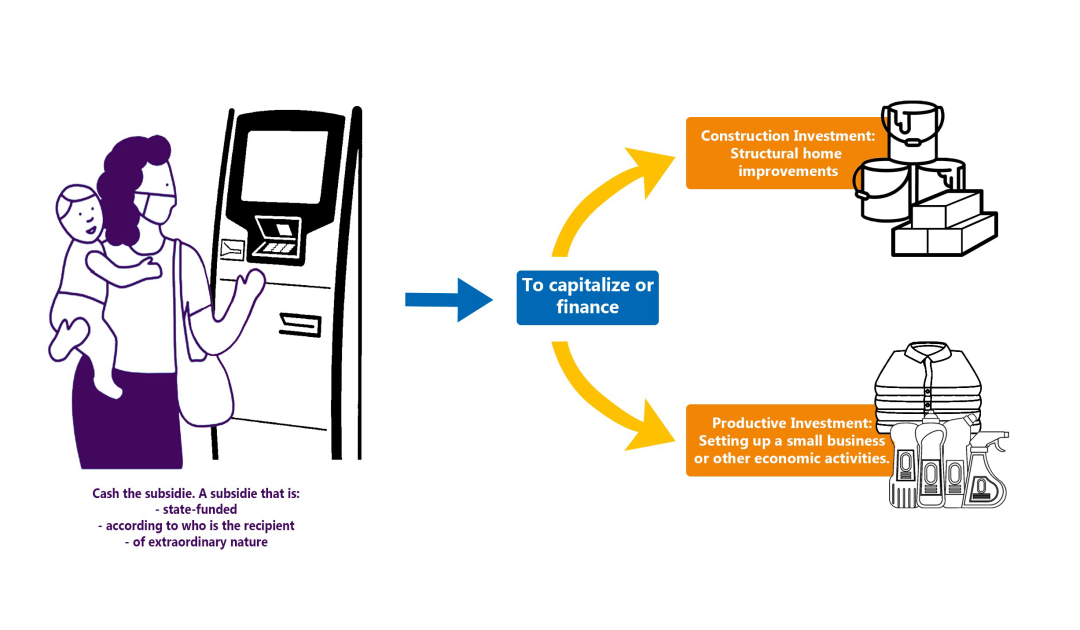

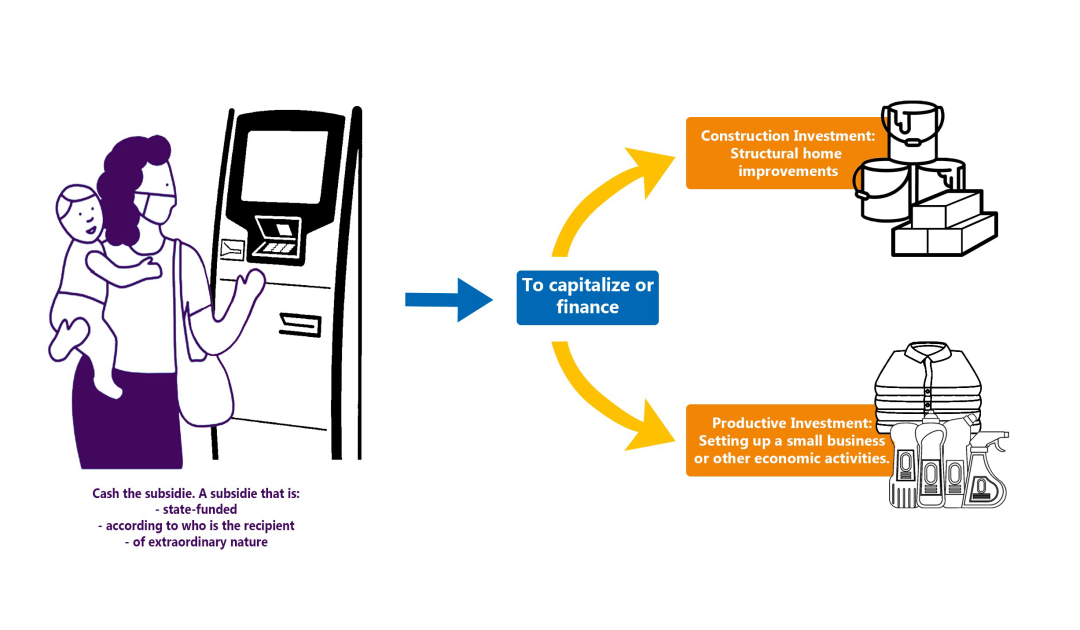

For people from low-income households, access to financing is a deep-rooted problem related to a low level of financial soundness and, in most cases, their precarious and/or temporary access to the labor market. This means that they are, mostly, in the informal sector of the economy. In this context, people use extraordinary subsidies provided by the state’s social welfare system as a means of capitalization and/or financing. This is due to the extraordinary nature of these funds, how they represent an otherwise inaccessible large sum of money for families, and the fact that they are not to be returned. Because they are not perceived as a regular income of the household economy, they are perceived and managed differently. In this case, to start a new economic activity. For instance, the Emergency Family Income (IFE, by its initials in Spanish) was repeatedly used as an individual financing strategy during the pandemic (investment capital) for new ventures such as, for example, the purchase and sale of products and/or food. It was also used to make collective purchases in which groups of people get together to lower costs or to constitute a common fund. This was a widely seen strategy during the “Mujeres en red” (Women in Network) Solutions Mapping, where we interviewed women from low-income areas in regard to their solutions to face the economic consequences of the COVID-19 pandemic. According to one of their testimonies: “We spent the first aid because we didn't think they were going to give it again. We bought merchandise, everything. Afterwards, the second time, I told my husband ‘Why don't we invest, or do something?’. He told me ‘Well, go ahead’. So, we bought clothes and he went to pick them up for me. He also did the deliveries for me.” Interview #49 young women from “Mujeres en red: soluciones financieras y de recuperación socioeconómica” (Women in Network: Financial and Socioeconomic Recovery Solutions). People who benefit from this type of money transfer policy use the amount of money received for a long-term project or economic activity that exceeds the survival or more formal expectations of the intended policy. This is why this type of strategy can be referred to as “policy reappropriation”. When these transfers are done consistently, families come to consider the amounts as an available sum of their domestic economy. Extraordinary transfers can have a bigger impact on these households, as their unexpected nature turns them into available capital that can be invested to carry out small businesses or home construction/renovations.

https://www.undp.org/es/argentina/publications/mujeres-en-red-soluciones-financieras-y-de-recuperacion-socioeconomica

https://www.undp.org/es/argentina/publications/busqueda-compartida-mapeo-de-soluciones-colaborativo-inclusion-financiera-y-recuperacion-economica https://www.undp.org/es/argentina/publications/de-cerca-inclusion-financiera-y-soluciones-territoriales

Consent to share form or official link.

Consent to share form or official link.

1No poverty

1No poverty 8Decent work and economic growth

8Decent work and economic growth 10Reduced inequalities

10Reduced inequalities 17Partnerships for the goals

17Partnerships for the goals

Comments

Log in to add a comment or reply.